CANARA ROBECO ELSS TAX SAVER - REGULAR PLAN - GROWTH OPTION

(Erstwhile Canara Robeco Equity Taxsaver - Regular Plan - Growth)

Fund House: Canara Robeco Mutual Fund| Category: Equity: ELSS |

| Launch Date: 05-02-2009 |

| Asset Class: Equity |

| Benchmark: BSE 500 TRI |

| TER: 1.71% As on (28-02-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 500.0 |

| Minimum Topup: 500.0 |

| Total Assets: 7,724.22 Cr As on 28-02-2025(Source:AMFI) |

| Turn over: 32% | Exit Load: Nil. Eligible for availing tax benefits under Section 80C of IT Act, 1961 subject to the limits and condition specified in Section 80C, read with Section 80CCE of the Act under ELSS,2005 vide notifications dt. 03.11.2005 and 13.12.2005. This investment is subject to a lock in period of 3 years from the date of allotment . |

153.11

-0.5 (-0.3266%)

18.14%

Benchmark: 12.15%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

NIFTY 500 TRI

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

0 Years 7 Months

5 Years 4 Months

8 Years 1 Months

12 Years 3 Months

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

The scheme seeks to achieve long term capital appreciation by predominantly investing in equities. It also offers tax benefits under Section 80C. The investments may be made in primary as well as secondary markets and schme may also invest in overseas equity markets like ADRs/GDRs.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 13.61 |

| Sharpe Ratio | 0.34 |

| Alpha | -1.65 |

| Beta | 0.92 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| CANARA ROBECO ELSS TAX SAVER - REGULAR PLAN - GROWTH OPTION | 05-02-2009 | 4.7 | 17.13 | 12.05 | 19.71 | 12.37 |

| WhiteOak Capital ELSS Tax Saver Fund Regular Plan Growth | 14-10-2022 | 13.31 | 25.98 | - | - | - |

| LIC MF ELSS Tax Saver-Regular Plan-Growth | 31-03-1997 | 13.17 | 20.66 | 13.88 | 16.67 | 10.15 |

| HSBC ELSS Tax saver Fund - Regular Growth | 01-01-2013 | 12.1 | 23.2 | 15.1 | 19.89 | 11.76 |

| DSP ELSS Tax Saver Fund - Regular Plan - Growth | 05-01-2007 | 11.62 | 24.29 | 17.21 | 23.21 | 14.39 |

| Motilal Oswal ELSS Tax Saver Fund - Regular Plan - Growth Option | 05-01-2015 | 11.08 | 26.64 | 19.98 | 20.69 | 14.68 |

| JM ELSS Tax Saver Fund (Regular) - Growth option | 31-03-2008 | 10.49 | 23.15 | 16.53 | 20.99 | 13.59 |

| Parag Parikh ELSS Tax Saver Fund- Regular Growth | 07-07-2019 | 9.38 | 20.34 | 16.69 | 24.5 | - |

| HSBC Tax Saver Equity Fund - Growth | 05-01-2007 | 8.7 | 22.93 | 14.49 | 19.24 | 11.22 |

| BARODA BNP PARIBAS ELSS Tax Saver Fund - Regular - Growth Option | 05-01-2006 | 8.61 | 22.39 | 14.19 | 17.91 | 10.7 |

Scheme Characteristics

Minimum investment in equity & equity related instruments - 80% of total assets (in accordance with Equity Linked Saving Scheme, 2005 notified by Ministry of Finance).

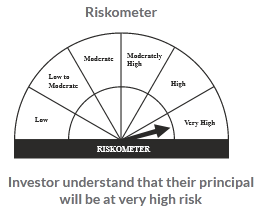

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

10.72%

Others

4.41%

Large Cap

68.99%

Mid Cap

15.88%